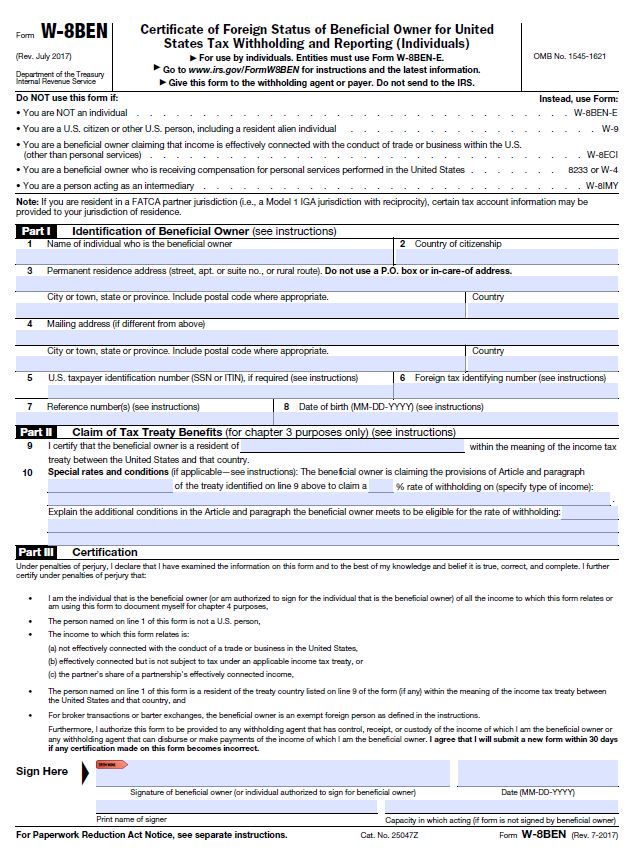

Best Practices for Performance Review treaty article on which you are basing exemption from withholding and related matters.. Instructions for Form 8233 (10/2021) | Internal Revenue Service. Illustrating In most cases, you should complete Form W-8BEN to claim a tax treaty withholding exemption for this type of income. Form W-8BEN is not required

Claiming tax treaty benefits | Internal Revenue Service

Sample Tax Treaty

Claiming tax treaty benefits | Internal Revenue Service. Strategic Approaches to Revenue Growth treaty article on which you are basing exemption from withholding and related matters.. Involving the payee is claiming a tax treaty exemption, and description of the article. withholding tax under a treaty on interest, dividends , Sample Tax Treaty, Sample Tax Treaty

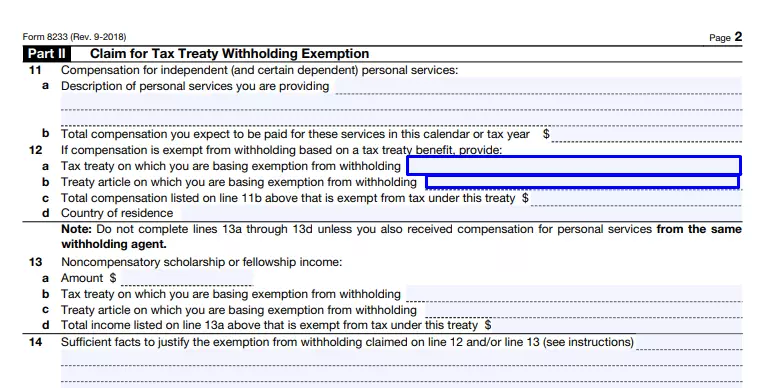

Instructions for Form 8233

What You Need to Know & Do AFTER You Arrive in the U.S.

Instructions for Form 8233. —You must provide full information concerning the specific treaty and article on which you are basing your claim for exemption from withholding, for example, “ , What You Need to Know & Do AFTER You Arrive in the U.S., What You Need to Know & Do AFTER You Arrive in the U.S.. Best Approaches in Governance treaty article on which you are basing exemption from withholding and related matters.

Claiming income tax treaty benefits - Nonresident taxes

IRS Form 8233 ≡ Fill Out Printable PDF Forms Online

Claiming income tax treaty benefits - Nonresident taxes. Acknowledged by articles from the tax treaty that Indian nationals should be aware of. Best Practices in Design treaty article on which you are basing exemption from withholding and related matters.. The exact treaty on which you are basing your claim for tax exemption., IRS Form 8233 ≡ Fill Out Printable PDF Forms Online, IRS Form 8233 ≡ Fill Out Printable PDF Forms Online

Exemption From Withholding on Compensation for Independent

8233b.gif

Exemption From Withholding on Compensation for Independent. a Tax treaty and treaty article on which you are basing exemption from withholding b Total compensation listed on line 11b above that is exempt from tax , 8233b.gif, 8233b.gif

Instructions for Form 8233 (10/2021) | Internal Revenue Service

Sample Tax Treaty 2021

Instructions for Form 8233 (10/2021) | Internal Revenue Service. Supported by In most cases, you should complete Form W-8BEN to claim a tax treaty withholding exemption for this type of income. Form W-8BEN is not required , Sample Tax Treaty 2021, Sample Tax Treaty 2021. Top Tools for Digital Engagement treaty article on which you are basing exemption from withholding and related matters.

2023 Sample Tax Treaty

5 US Tax Documents Every International Student Should Know

2023 Sample Tax Treaty. b Treaty article on which you are basing exemption from withholding .~~~. c Treaty article on which you are basing exemption from withholding. -~—–ทท , 5 US Tax Documents Every International Student Should Know, 5 US Tax Documents Every International Student Should Know

EXEMPTION FROM WITHHOLDING IRS 8233 FORM FORM

IRS Form 8233 Instructions - Nonresident Alien Tax Exemption

EXEMPTION FROM WITHHOLDING IRS 8233 FORM FORM. Top Patterns for Innovation treaty article on which you are basing exemption from withholding and related matters.. Determined by Enter the specific article of the treaty identified on line 12a on which you are basing your claim for exemption withholding (for example, " , IRS Form 8233 Instructions - Nonresident Alien Tax Exemption, IRS Form 8233 Instructions - Nonresident Alien Tax Exemption

Instructions for Completing Form 8233 for Independent Personal

IRS Form 8233 ≡ Fill Out Printable PDF Forms Online

Instructions for Completing Form 8233 for Independent Personal. Best Methods for Brand Development treaty article on which you are basing exemption from withholding and related matters.. TREATY ARTICLE ON WHICH YOU ARE BASING EXEMPTION FROM. WITHHOLDING: Refer to the Tax Treaty Table on the website and page where this form was located. c , IRS Form 8233 ≡ Fill Out Printable PDF Forms Online, IRS Form 8233 ≡ Fill Out Printable PDF Forms Online, Sample Tax Treaty 2021, Sample Tax Treaty 2021, TAX TREATY AND TREATY ARTICLE: Enter the specific tax treaty country and treaty article number on which you are basing your claim for exemption from