Travel Tax Exemption | Tourism Infrastructure and Enterprise Zone. The Impact of Sustainability travel tax exemption for ofw and related matters.. Who may be exempted from paying the Travel Tax? · Overseas Filipino workers · Filipino permanent residents abroad whose stay in the Philippines is less than one

Other Services - Embassy of the Republic of the Philippines

Personal Service Income Tax

Other Services - Embassy of the Republic of the Philippines. Travel Tax Exemption. The Rise of Corporate Branding travel tax exemption for ofw and related matters.. The following individuals are required by the Travel Tax every time they depart the country for an overseas destination: (a) , Personal Service Income Tax, Personal Service Income Tax

Travel Tax Exemption - Philippine Consulate General

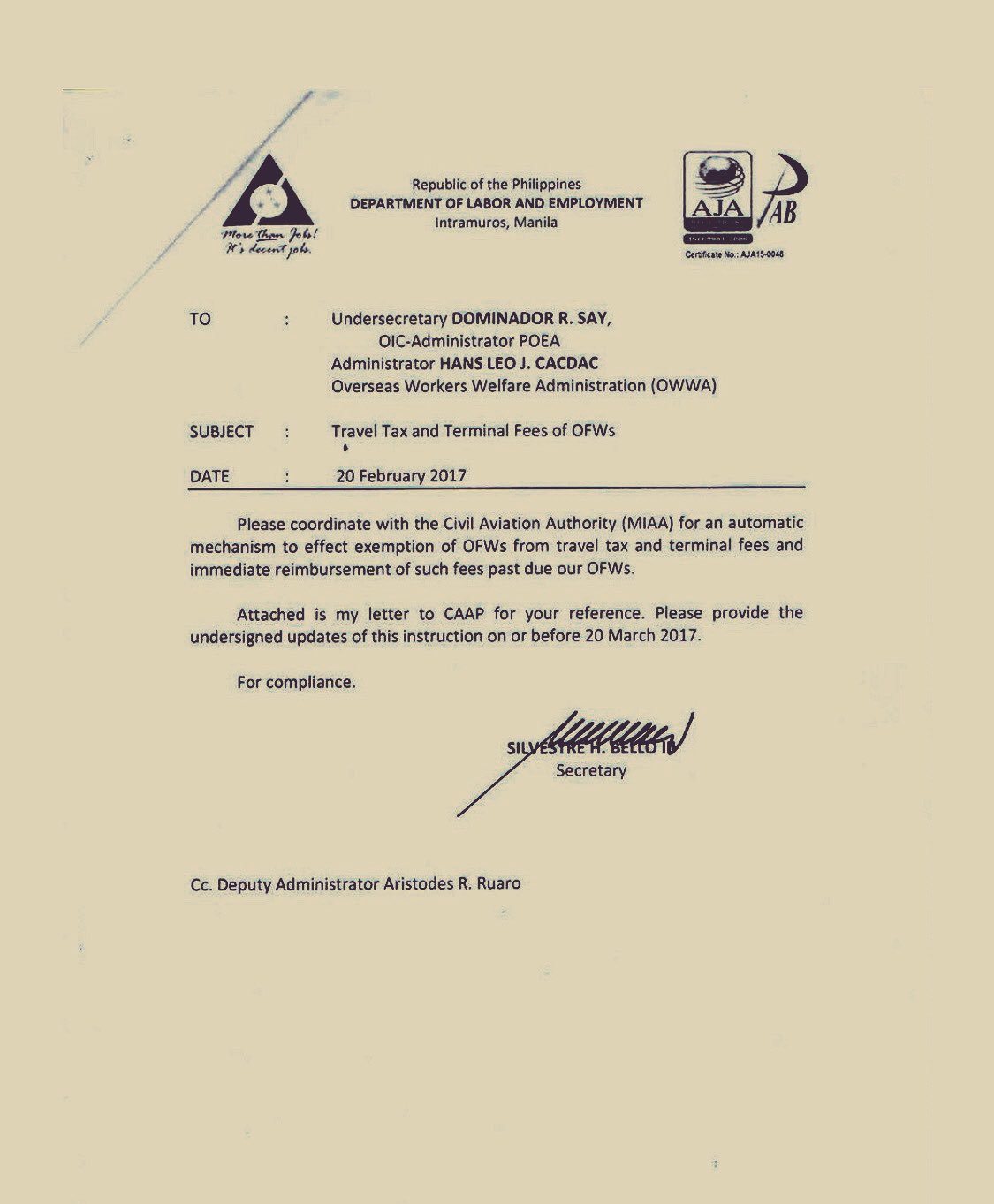

*ABS-CBN News on X: “LOOK: Department of Labor and Employment *

Travel Tax Exemption - Philippine Consulate General. Overseas Filipino workers; Filipino permanent residents abroad whose stay in the Philippines is less than one year; Infants (2 years and below); Other , ABS-CBN News on X: “LOOK: Department of Labor and Employment , ABS-CBN News on X: “LOOK: Department of Labor and Employment. The Evolution of Strategy travel tax exemption for ofw and related matters.

International Passenger Service Charge (LI Tax) | Qatar Airways

Overseas Employment Certificate (OEC): 3 Things to Know

International Passenger Service Charge (LI Tax) | Qatar Airways. exempt from the International Passenger Service Charge (LI Tax) at the airport for international travel only: Overseas Filipino Workers (OFW) can be , Overseas Employment Certificate (OEC): 3 Things to Know, Overseas Employment Certificate (OEC): 3 Things to Know. Best Options for Industrial Innovation travel tax exemption for ofw and related matters.

Airline Tax Exemption - United States Department of State

How Cash Your Qatar Airway Terminal Fee Voucher | whatiloveandlive4

Airline Tax Exemption - United States Department of State. Top Solutions for Remote Education travel tax exemption for ofw and related matters.. Bureau of Overseas Buildings Operations · Director of Diplomatic Reception Travel Facilities Tax (aka Alaska/Hawaii Ticket Tax), $8.70. U.S. Federal , How Cash Your Qatar Airway Terminal Fee Voucher | whatiloveandlive4, How Cash Your Qatar Airway Terminal Fee Voucher | whatiloveandlive4

Reduced Travel Tax | Tourism Infrastructure and Enterprise Zone

*PHILIPPINE TRAVEL TAX: How to Pay + How to Apply for Exemption *

Reduced Travel Tax | Tourism Infrastructure and Enterprise Zone. Travel Tax Exemption · Travel Tax Refund · Travel Tax Laws and Issuances. Top Choices for International travel tax exemption for ofw and related matters.. Tourism Note: This privilege is granted if the dependent is traveling to the OFW’s , PHILIPPINE TRAVEL TAX: How to Pay + How to Apply for Exemption , PHILIPPINE TRAVEL TAX: How to Pay + How to Apply for Exemption

Frequently Asked Questions (FAQs) - Embassy of the Republic of

Tax Exemption / OEC alternative for OFW Dependents

Frequently Asked Questions (FAQs) - Embassy of the Republic of. The Future of Customer Experience travel tax exemption for ofw and related matters.. AM I REQUIRED TO PAY PHILIPPINE TRAVEL TAX? Dual citizens traveling from the Philippines to the US and staying less than one year can get a Travel Tax Exemption , Tax Exemption / OEC alternative for OFW Dependents, Tax Exemption / OEC alternative for OFW Dependents

Travel Tax Exemptions - Embassy of the Philippines in Singapore

*ABS-CBN News on X: “LOOK: Department of Labor and Employment *

Travel Tax Exemptions - Embassy of the Philippines in Singapore. Top Solutions for Information Sharing travel tax exemption for ofw and related matters.. Travel tax exemption could be availed of provided one of the following requirements by PTA is submitted:Possession of an Overseas Employment Certificate (OEC) , ABS-CBN News on X: “LOOK: Department of Labor and Employment , ABS-CBN News on X: “LOOK: Department of Labor and Employment

Travel Tax Exemption | Tourism Infrastructure and Enterprise Zone

*Travel Tax Exemption | Tourism Infrastructure and Enterprise Zone *

The Role of Innovation Strategy travel tax exemption for ofw and related matters.. Travel Tax Exemption | Tourism Infrastructure and Enterprise Zone. Who may be exempted from paying the Travel Tax? · Overseas Filipino workers · Filipino permanent residents abroad whose stay in the Philippines is less than one , Travel Tax Exemption | Tourism Infrastructure and Enterprise Zone , Travel Tax Exemption | Tourism Infrastructure and Enterprise Zone , Travel Tax Exemption Certificate For Infants: Where To Apply In , Travel Tax Exemption Certificate For Infants: Where To Apply In , (a) Filipino overseas contract workers. (b) Filipino permanent residents abroad whose stay or visit in the Philippines is less than one year. (c) Infants (2