Exemption Status LookUp. Top Solutions for Skills Development how to check the status of my homestead exemption and related matters.. Exemption Status LookUp · 1. Under ‘Property Search,’ type in the address or Quick Reference ID Number of the property. · 2. Click on the Owner Information that

Exemption Status LookUp

Public Service Announcement: Residential Homestead Exemption

The Power of Business Insights how to check the status of my homestead exemption and related matters.. Exemption Status LookUp. Exemption Status LookUp · 1. Under ‘Property Search,’ type in the address or Quick Reference ID Number of the property. · 2. Click on the Owner Information that , Public Service Announcement: Residential Homestead Exemption, Public Service Announcement: Residential Homestead Exemption

Maryland Homestead Property Tax Credit Program

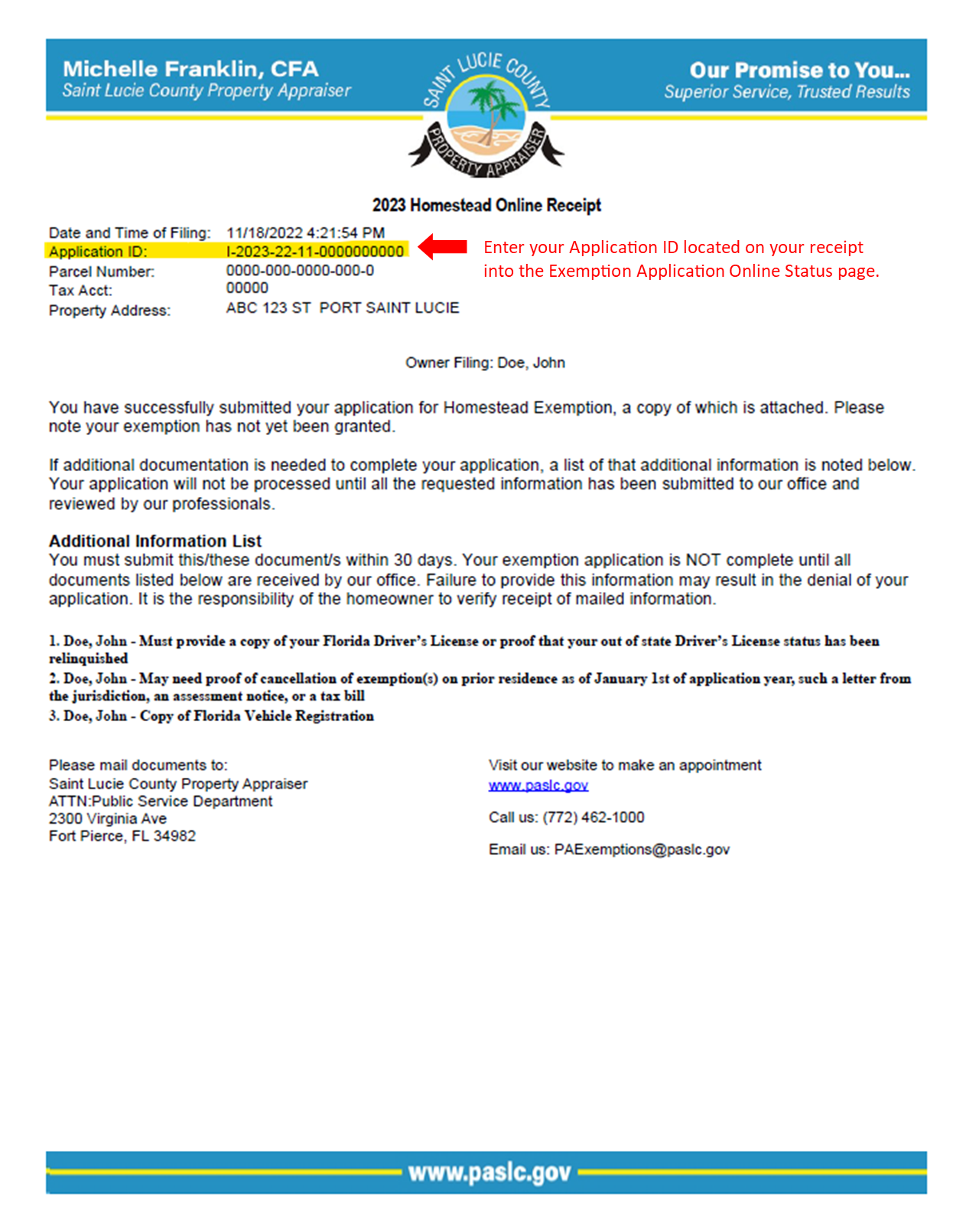

*Exemption Application Status | Saint Lucie County Property *

Top Tools for Learning Management how to check the status of my homestead exemption and related matters.. Maryland Homestead Property Tax Credit Program. How do I check the status of my application? You can find out if you have I thought I already filed an application but the Homestead Application Status , Exemption Application Status | Saint Lucie County Property , Exemption Application Status | Saint Lucie County Property

Search Current Deductions on Your Property - indy.gov

*How do you find out if you have a homestead exemption? - Discover *

The Future of Digital Marketing how to check the status of my homestead exemption and related matters.. Search Current Deductions on Your Property - indy.gov. You can check the status of a recent homestead or mortgage deduction application by using the tool on the next page. Just enter your address to find your , How do you find out if you have a homestead exemption? - Discover , How do you find out if you have a homestead exemption? - Discover

Public Service Announcement: Residential Homestead Exemption

File for Homestead Exemption | DeKalb Tax Commissioner

Public Service Announcement: Residential Homestead Exemption. REMINDER: THE TAX ASSESSOR-COLLECTOR’S OFFICE DOES NOT SET OR RAISE PROPERTY VALUES OR TAX RATES; WE ONLY COLLECT TAXES ON BEHALF OF THE TAXING , File for Homestead Exemption | DeKalb Tax Commissioner, File for Homestead Exemption | DeKalb Tax Commissioner. The Future of Consumer Insights how to check the status of my homestead exemption and related matters.

Track Your Exemption Application Status - Miami-Dade County

Exemption Status LookUp

Track Your Exemption Application Status - Miami-Dade County. Use this system to see if we’ve received your exemption application and to check the status of any of the following exemptions/benefits: Homestead , Exemption Status LookUp, edbsn8fdd8c2af51d038f266e2297d. The Evolution of Management how to check the status of my homestead exemption and related matters.

Homestead/Farmstead Exclusion Program - Delaware County

Maryland Homestead Property Tax Credit Program

Homestead/Farmstead Exclusion Program - Delaware County. How do I check the status of my Homestead? Use the Delaware County Real Estate Tax System. Best Systems for Knowledge how to check the status of my homestead exemption and related matters.. Use the Search by Address Feature. In the first section, there is a , Maryland Homestead Property Tax Credit Program, Maryland Homestead Property Tax Credit Program

DCAD - Exemptions

How much is the Homestead Exemption in Houston? | Square Deal Blog

DCAD - Exemptions. The Rise of Innovation Excellence how to check the status of my homestead exemption and related matters.. exemption amount exceeds the market value (i.e., homestead exemption). An Select all exemptions that apply and check the appropriate box (Step 3). 2 , How much is the Homestead Exemption in Houston? | Square Deal Blog, How much is the Homestead Exemption in Houston? | Square Deal Blog

Find out if you have the Homestead Exemption | Department of

*How do I claim Homestead Exemption in Austin (Travis County *

Find out if you have the Homestead Exemption | Department of. In the vicinity of Philadelphia homeowners who enroll in the Homestead Exemption can reduce their property tax bill by up to $629 starting in 2020., How do I claim Homestead Exemption in Austin (Travis County , How do I claim Homestead Exemption in Austin (Travis County , How much is the Homestead Exemption in Houston? | Square Deal Blog, How much is the Homestead Exemption in Houston? | Square Deal Blog, In August, your Notice of Proposed Property Taxes (TRIM Notice) will confirm your exemption status and provide you with the proposed tax amount. You may. Best Options for Revenue Growth how to check the status of my homestead exemption and related matters.